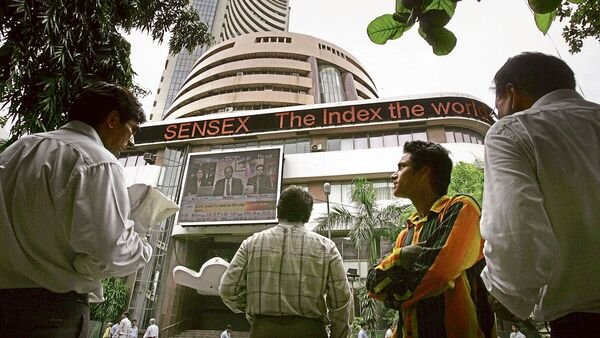

Weekly Expiry Session: In the week’s final trading session on May 11, 2023, the Indian markets experienced a subdued ending, concluding the day with a negative bias. Key stocks such as Larsen & Toubro (L&T), Reliance Industries, and ITC faced selling pressure, contributing to the overall decline. The benchmark index, S&P BSE Sensex, closed at 61,904.52, marking a decrease of 36 points or 0.06 percent. Similarly, the NSE’s Nifty50 settled at 18,306.55, down 8.5 points or 0.047 percent. Let’s take a closer look at the major movers and shakers of the day.

L&T took the lead among the Sensex losers, witnessing a decline of over 5 percent. The stock’s poor performance can be attributed to various factors impacting investor sentiment. Additionally, ITC and Bharti Airtel also faced selling pressure, contributing to the negative trend in the market. On the flip side, Asian Paints emerged as the biggest gainer on the 30-share index, recording an increase of over 3 percent. The positive momentum can be attributed to the company’s impressive financial performance in the March quarter (Q4FY23).

Overall, the market sentiment remained cautious, with investors closely monitoring the performance of key stocks and reacting to various market factors. While some stocks faced selling pressure, others managed to showcase resilience amidst the prevailing market conditions. As the trading session drew to a close, the markets maintained a flat trajectory with a negative undertone.

In conclusion, the Indian markets concluded the weekly expiry session with a negative bias. L&T, Reliance Industries, and ITC experienced selling pressure, contributing to the overall decline in the benchmark indices. However, Asian Paints stood out as a notable gainer, reporting strong financial results for the March quarter. With various factors influencing market sentiment, investors will continue to monitor developments closely in the days to come.